Did you know that 80% of borrowers using FHA mortgages are eligible for DPA, but only 15% receive it?

Access to information on down payment assistance has never been easier for agents than with Down Payment Resource, which is built right into our MLS!

How can agents close the gap for any buyer who could use a boost? Here are 5 action items:

1. Educate Buyers About Down Payment Assistance (DPA) Programs

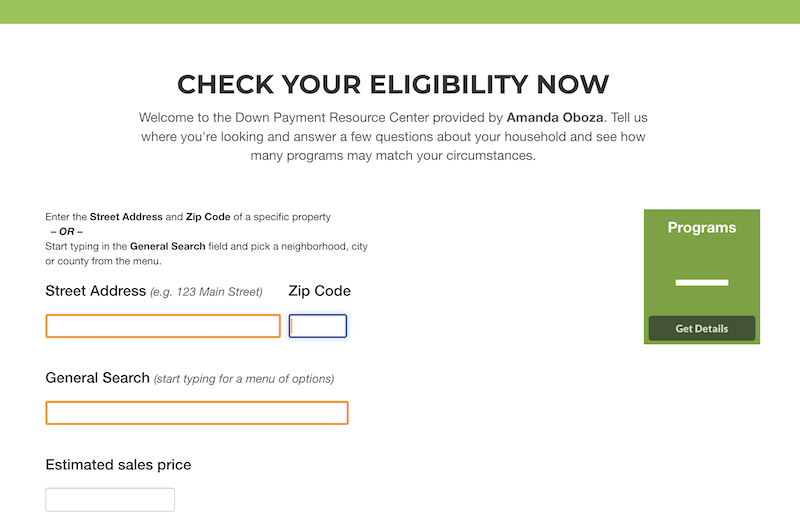

Many buyers are unaware of programs available. As real estate experts, agents should be shouting this information for all to hear. All members of the Greater Lansing Association of REALTORS® already have a dedicated, personalized landing page set up for them. These landing pages include program details, including eligibility criteria. Find and utilize your landing page now!

2. Foster Strong Agent and Loan Officer Partnerships

Collaborate to ensure a smooth process by aligning expectations, educating buyers early, and sharing resources for local and national programs.

3. Streamline Processes to Address Misperceptions About Delay

Build familiarity with down payment assistance timelines, requirements like homebuyer education early, and maintain strong communication among all parties.

4. Utilize Tools and Resources to Expand Knowledge and Networks

Down Payment Resource has a constant rotation of webinars agents can watch, both live and recorded. Check them out here!

In addition, leverage educational content and engage with networking tools like Facebook groups for DPAs. Join the Down Payment Insiders Facebook group

5. Advocate for the Value of DPA

Always promote the value in down payment assistance to colleagues, community members and government officials. Highlight that DPA buyers are still qualified buyers and provide assurance about transaction timelines through clear communication and preparation. This emphasizes building trust and confidence among all parties in the transaction process.