Top 10 Takeaways: Making Your Money Work For You

1. It is equally important to plan for saving for retirement AND for withdrawing after retirement.

2. How you plan for retirement depends on what stage you are at in life. A trusted financial advisor will be able to use their expert opinion to guide people on what is best for their scenario.

3. Geopolitical events, such as war, can impact your investments.

4. People are living longer now. This is something people need to plan for. Statistics show the following for married

couples at age 65.

90% chance one will live to 85

73% chance one will live to 90

46% chance one will live to 95

19% chance one will live to 100

5. 3 strategies for managing all of the risks include:

-Risk tolerance

-Time horizon

-Diversification

6. Diversification is key when it comes to planning for retirement.

7. Review risks and performance relative to short and long term horizons.

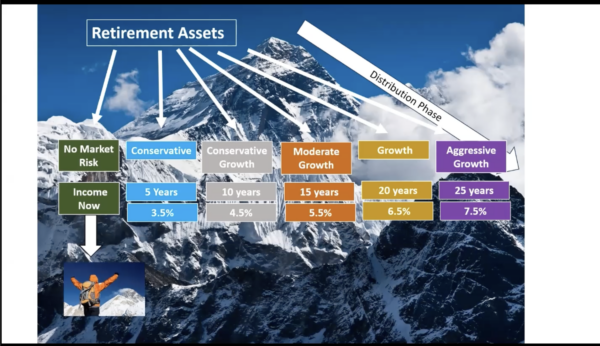

8. Each of these investments has a place and a purpose in your pre and post retirement journey.

9. There are a variety of investment opportunities for self employed individuals, like REALTORS®. Check out some options below:

10. Be cautious about selecting an advisor. Be sure you find one who truly cares about you and wants to understand your goals.

November 2023 Greater Lansing Association of REALTORS® Industry Update on October 19, 2023.

Thank you to presenters:

-Scott Morrison, Morrison Nordmann Wealth Management

-Matt Nordmann, Morrison Nordmann Wealth Management

-Jeff Bone: 2023 President, Greater Lansing Association of REALTORS®